- What We InsureWhat We Insure

How we can help you

- AssociationsAssociations

Designed to meet the collective needs of association members, our marine insurance supports organisations that bring people together through sailing and boating. With deep industry knowledge, we help tailor cover for your activities, assets, and people—ensuring your association is protected.

- Boat RepairsBoat Repairs

Boat repairers keep the marine industry afloat. And with such a variety of vessels in use around the world, boat repair businesses are just as wide-ranging. Our experienced marine repair insurance team can find the right cover for boat repair businesses.

- Boat DealersBoat Dealers

Whether you deal with luxury yachts, motorboats, cruisers or commercial boats, we can tailor your boat dealer insurance to your specifications. We will talk you through options to cover risks such as your stock and liability.

- BoatyardsBoatyards

When you operate a boatyard, you must ensure the vessels in your care are kept in pristine condition. So it’s vital they’re protected. With Haven Knox-Johnston’s boat yard insurance cover, you can rest with ease knowing you’re in the right hands.

- ChandleriesChandleries

Every type of boat and yacht needs care to stay seaworthy, that’s why chandleries are so important. Our expert team have the knowledge and experience in Chandlery insurance to find the right level of cover and tailor it to your business.

- CharitiesCharities

Charities play an important role in the marine sector – offering people of all ages and circumstances much-needed support and new opportunities that can change lives. With our expert knowledge of the marine industry, we can tailor your insurance to the unique needs.

- Charter CompaniesCharter Companies

Marine charters play an important role on the global stage – enabling everything from the transport of cargo to offshore support. All charter marine companies need specialist marine charter insurance for their particular level of risk.

- MarinasMarinas

Whether you operate a small riverside marina or a large coastal marinas with over a thousand berths, you’ll need specialist marina insurance that can protect you, your business and your customers.

- RiggersRiggers

By talking to you and getting to know your business, we will be able to source the most appropriate riggers insurance from our network of providers and tailor your policy to match your liability.

- Sailing ClubsSailing Clubs

Every sailing and boating club operates differently, so we take the time to understand how you run yours, which means we understand the importance of protecting your club with the right sailing club insurance.

- Sailing SchoolsSailing Schools

Depending on how you teach, your pupils, and the size and activities of your school. We have the marine industry connections and strong network of insurers to ensure your sailing classes are correctly covered.

- SurveyorsSurveyors

As a marine surveyor, it’s your responsibility to assess the condition of a vessel, from its hull to its machinery. As surveying a boat is an important part of the sales process, for peace of mind it’s worth covering yourself with marine surveyor insurance.

- TradesmenTradesmen

Use Haven Knox-Johnston Commercial to provide your marine trade insurance for peace of mind. We understand that every tradesman operates differently, so we’ll dive into the details of your business to find a policy that suits your needs.

- Yacht ClubsYacht Clubs

We aim to get to know your club, so we can provide the right yacht club insurance to protect you and the facilities you offer. From the secure storage of your members’ personal data to the safe running of events, we cover it all.

- AssociationsAssociations

- Our CoverOur Cover

How we can help you

- About UsAbout Us

Who is Haven Knox-Johnston Commercial and where do we come from?

- Meet the TeamMeet the Team

Meet the Commercial Team

- SustainabilitySustainability

The commercial marine industry must move towards more sustainable practices amidst growing environmental concerns and regulatory requirements.

- A guide to sustainable strategies for the maritime industryA guide to sustainable strategies for the maritime industry

A guide to sustainable strategies for the maritime industry

- A guide for small Marine Trade businessesA guide for small Marine Trade businesses

Industry change requires accountability for marine impact. Even small businesses can adopt eco-friendly practices to safeguard our waters.

- A guide to sustainable strategies for the maritime industryA guide to sustainable strategies for the maritime industry

- Commercial Introducer SchemeCommercial Introducer Scheme

Partner with us through our Commercial Introducer Scheme

- Refer a businessRefer a business

Refer a business and both receive a £50 Amazon voucher

- Meet the TeamMeet the Team

- NewsNews

The latest news and insights, tips and other helpful information from your Commercial team

- Get the latest newsGet the latest news

The latest news and insights, tips and other helpful information from your Commercial team

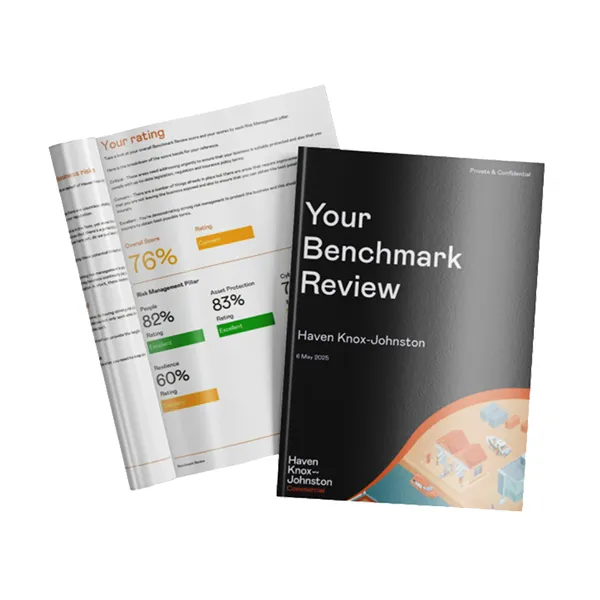

- NEW Benchmark Review ReportNEW Benchmark Review Report

The Benchmark Review Report is a risk management tool built to help you take control, identify vulnerabilities, and gain confidence in the areas you’re getting right.

- EventsEvents

From sponsorships to Trade shows, check out what our Commercial team are up to

- Crick Boat Show - OverviewCrick Boat Show - Overview

Overview of Crick Boat Show

- Seawork - OverviewSeawork - Overview

Overview of Seawork

- Crick Boat Show - OverviewCrick Boat Show - Overview

- Get the latest newsGet the latest news

- ContactContact

Our dedicated account handlers are available to help with any queries.